Powered by xeven pixels | Website design | seo

Share Article

Copy link

Copied to clipboard!

2 days ago

Ever feel like your paycheck disappears before the next paycheck? That was me in early 2025. Thanks to the 50/30/20 budget rule, I started gaining progress from week 1.

I was just juggling bills, food deliveries, and subscriptions and somehow never managed to save. My budget felt like a puzzle missing half the pieces. That’s when I came across this rule. This method provides a framework that everyone calls simple, practical, and timeless.

So I decided to test it. Would I be able to fit my unpredictable expenses into neat percentages? Would savings finally stick if I stayed consistent?

Ready to build savings for tomorrow? Keep reading to see and discover what really happened when I put it into practice.

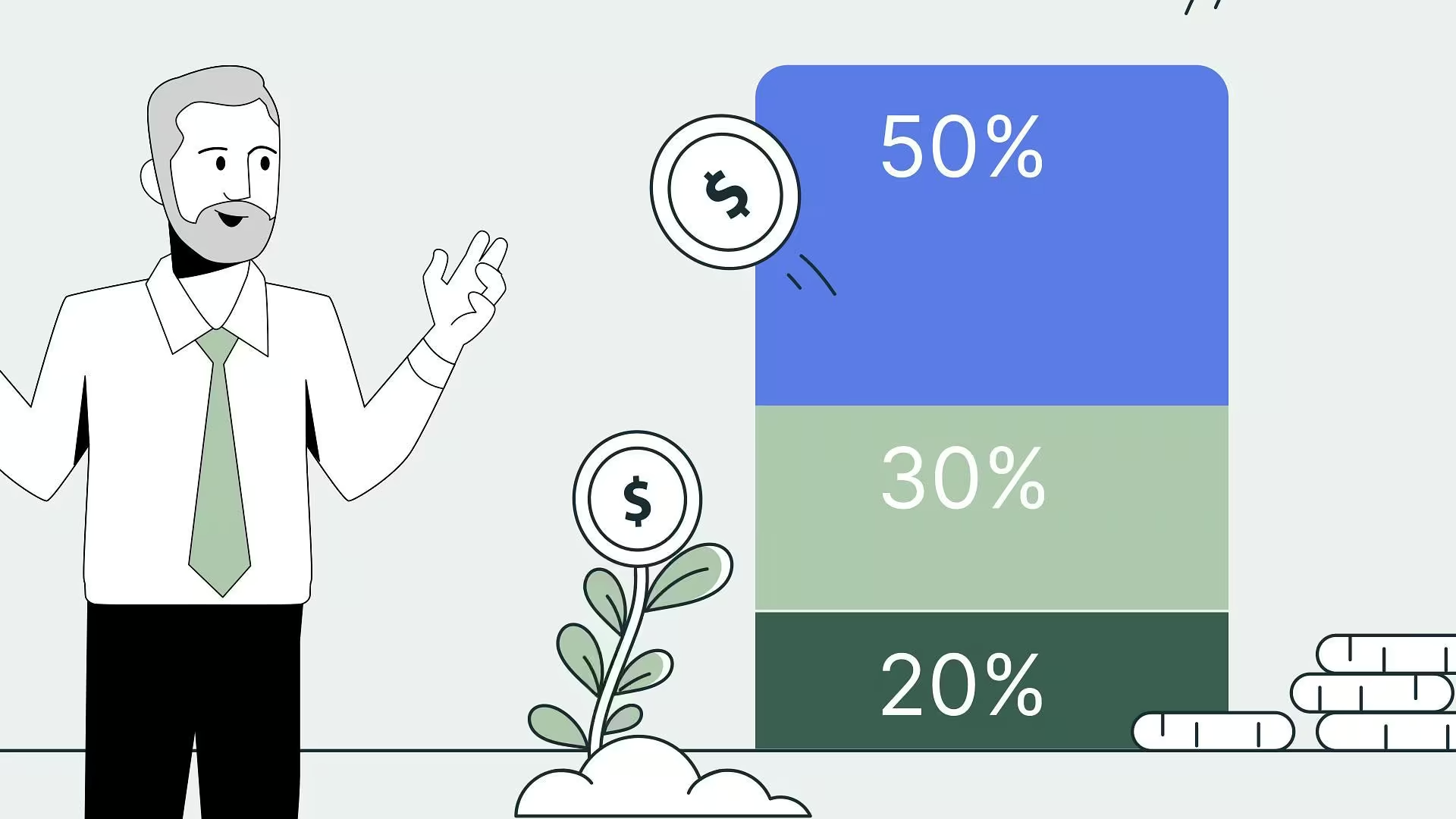

What Is the 50/30/20 Rule? The 50/30/20 rule dictates how to split your after-tax income into 50% for needs, 30% for wants, and 20% for savings. U.S. Sen. Elizabeth Warren popularized this rule in her book, “All Your Worth: The Ultimate Lifetime Money Plan.”

This rule helps you draw up a reasonable budget that you can follow consistently to meet your financial goals.

Needs are the essentials that you must pay for survival. This budget plan allocates half your after-tax income to needs and obligations. Needs include:

These simple birthday celebration ideas are affordable but packed with personality.

Wants are those things that aren’t absolutely essential. For instance, you can work out at home, but you go to the gym. Similarly, you might want to get tickets for a basketball game instead of watching it on a TV.

This category also includes upgrades you want to make. Examples of wants include:

These simple birthday celebration ideas are affordable but packed with personality.

This rule allocates 20% of your income to savings and investments. If it’s possible, build an emergency fund for at least three months. Focus on retirement and meeting more distant financial goals.

Examples of savings include:

The framework forces clarity. People even use a 50/30/20 rule calculator or template to track their splits.

Pro tip: Think of 50/30/20 as guardrails, not handcuffs.

When I first set up the rule, I thought it would be a cakewalk. Just divide my income into neat buckets and stick to it. But real life is messy. I hit roadblocks within the first month. Rent and groceries already pushed the “needs” category beyond 55%. That meant trimming my “wants” category became necessary.

I used a 50/30/20 rule spreadsheet to track my spending. The visual layout helped me see where money was going. For example, online shopping disguised itself as a “need” in my mind. Writing it down revealed the truth. It was wasting my savings.

Still, the rule worked as a wake-up call. I didn’t hit the exact ratios, but I was mindful of my expenses. My savings rate jumped from 10% to 18% in the next three months. That progress felt real.

Start today. Don’t stress about perfection. Focus on consistency.

The 50/30/20 rule sounded flexible, but it wasn’t always a straightforward path. The rule follows net income, but I was confused about whether to budget on gross or net income. Using gross felt generous, but my actual spending power was below the net income. That mismatch led to the first draft of my budget being unrealistic.

Another challenge was lifestyle creep. For extra cash, I felt tempted to spend on wants. Streaming subscriptions, weekend outings, and quick food deliveries stacked quickly. The spreadsheet showed every extra dollar spent there meant one less for savings.

Emergencies also didn’t fit neatly into any category. One family member’s health issues threw my balance off, and I dipped into the savings portion. It was frustrating but also an eye-opener.

Over time, I realized the rule isn’t about perfection; it’s about awareness.

Pro tip: Think of the rule as a compass, not a cage. Even when I drifted off-track, the framework helped me develop lasting money habits.

No single way for budgeting will work for everyone. But these high-level tips on adopting a 50/30/20 budget cover nearly all individuals.

Track Your Expenses: Keep track of your expenses for a month or two to understand where your money goes. Analyze your spending to determine how closely it relates to the rule. Tracking your actual spending might help you adhere to the rule. You can also use spreadsheet programs such as Google Sheets or Microsoft Excel.

Understand your income: The rule links to the firm grasp of your income. Remember, gross income can vary from net income. Gross income means the money before taxes, while net income means after-tax income. Understanding what you earn will put you in a better position to establish the correct budget amounts.

Identify your major costs: Major costs in life are rent, groceries, utilities, transportation, insurance premiums, and debt repayments. You can’t survive without paying for them. They may take up the largest portion of your budget, so make sure you identify them correctly.

Automate Your Savings: Saving will be simpler with an automatic process. Set up monthly automatic payments directly from paycheck. This guarantees that your funds grow over time.

Maintain Consistency: Consistency is the key. Stick to your spending strategy and resist the desire to break percentage allocations. This spending plan will be more successful if you follow clear guidelines.

Without the right tools, I would give up halfway. Tracking and visualizing numbers made 50/30/20 less stressful and more practical.

I tested a 50/30/20 budget template in Google Sheets. It gave me a simple dashboard. I put in entries and found if I was overspending on wants or lagging in savings. Later, I experimented with a 50/30/20 budget template Excel version. It was better offline when I didn’t want to depend on Wi-Fi.

A 50/30/20 rule calculator app made life easier. Punch in your income, and instantly get the split. No math, no guesswork. I even tested a few alternatives like the 40-30-20-10 rule calculator to check flexibility.

I checked 50/30/20 rule Reddit threads to see how others are experiencing it. Reading real stories helped me realize that the struggle was normal for beginners.

Eventually, I kept using a 50/30/20 budget template in Google Sheets. It synced well across devices. That way, it was easy to update spending from my phone after every purchase.

By the third month, I finally started seeing real progress. The changes weren’t overnight. Steady adjustments reshaped my money habits.

Better Awareness: The biggest win was awareness. Tracking every dollar showed where my money was leaking. I stopped those leaks like I stopped calling dining out a “need” and owned it as a want.

Savings Growth: After three months, my savings rate jumped from 10% to nearly 20%. Using a 50/30/20 budget template kept me focused. Even when I overspent on wants, my savings didn’t dip below 15%.

Debt Reduction: My 20% split for debt repayment worked better than I expected. Chipping away at my credit card balance kept me consistent.

Peace of Mind: The real payoff was mental. I stopped feeling guilty about small indulgences because I planned for them. That balance made the budget sustainable.

The 50/30/20 method accompanies several excellent budgeting styles out there. I compared it to others and noticed strengths and weaknesses that shaped how I use it today.

I used a 40-30-20-10 rule calculator just for fun. It splits 40% to needs, 30% to wants, 20% to savings, and 10% to investments or charity. When I got into details, I found it too strict for my lifestyle.

Classic line-item budgeting tracks every expense from rent, food, and entertainment to insurance. It’s precise but time-consuming. 50/30/20 is refreshingly simple compared to traditional budgeting.

Zero-based budgeting requires giving every dollar a purpose. It creates discipline but can feel overwhelming. On the other hand, the 50/30/20 split gives structure without micro-managing.

Each system works if you commit. For me, the 50/30/20 establishes the balance between structure and freedom. It’s simple enough to stick with and flexible enough to adapt.

All rules for budgeting aren’t one-size-fits-all. From my experience, 50/30/20 works great for many people but limiting for others.

For these groups, a 50/30/20 rule calculator or template often does the job to stay consistent.

This rule is a game changer if your income is stable and your expenses are moderate. But if your costs are unusually high, it’s not a hard law for you. Treat it as a guideline.

After months of trial and error, the 50/30/20 started giving me something more than just numbers. It changes how I think about money.

Clarity Over Confusion: For the first time, I didn’t hear “build your budget” because I had a clear system. No second-guessing. Even a simple 50/30/20 budget template in Google Sheets helped me look at my finances beyond how much I save.

Needs vs. Wants Mindset: This rule forced me to be brutally honest, like build your own budget PC. Many of my moves, like gym memberships, streaming services, and spontaneous takeout, were “wants,” not “needs.” That shift alone made me save.

Progress, Not Perfection: I never hit the ratios perfectly, and I’m okay with that. The framework showed me that consistency matters more than perfection.

Confidence in Choices: Build your own budget planner helped me stop feeling guilty about small indulgences. I had a spending limit, and it gave me peace of mind and freedom at the same time.

Applying the 50/30/20 rule helped me gain control over my finances and actionable lessons. The method works like a rule of thumb for engagement ring budget. It’s not magic, but it’s a starting point that can help you build money habits that last.

Budgeting isn’t about cutting joy; it’s about balance. The 50/30/20 budget rule showed me the way to live my life today to the fullest while planning for tomorrow.

Template calculators, including ways to build your own PC budget, make budgeting and tracking easier. Whether you’re saving for retirement, paying off debt, or just wanting peace of mind, a simple system has no alternative.

Don’t overthink it. Start with your net income, divide it as per the rule, and see how it feels. We suggest giving yourself three months before judging results.

So here’s my challenge: use the rule for yourself. Get a template, an app, or even pen and paper. Then ask: Did it change the way I think about money?

Saving 50% of your income is excellent if manageable for you. It fast-tracks your major financial goals like debt freedom and retirement. Even starting with 20% is a huge step toward building financial security.

The 50/30/20 budget rule is effective because it simplifies your monthly budget. You simply allocate 50% to needs, 30% to wants, and 20% to savings. This move maintains balance without micromanaging every expense.

Many Reddit threads say it works best with steady income and moderate expenses. However, it becomes difficult with high rent, childcare, or irregular income. But the percentage split doesn’t necessarily have to be like the rule. You can make adjustments.

Yes, the rule applies to net (after-tax) income to calculate the split. Using gross income can lead to unrealistic percentages.

For example, you earn $3,000 on a monthly income. The split will be $1,500 going to needs, $900 to wants, and $600 to savings or debt. This is a simple, real-life application of the rule.

This rule divides income into 70% spending, 10% saving, 10% investing, and 10% giving. It’s an alternative for people looking for more control over savings and philanthropy.