Powered by xeven pixels | Website design | seo

Share Article

Copy link

Copied to clipboard!

6 days ago

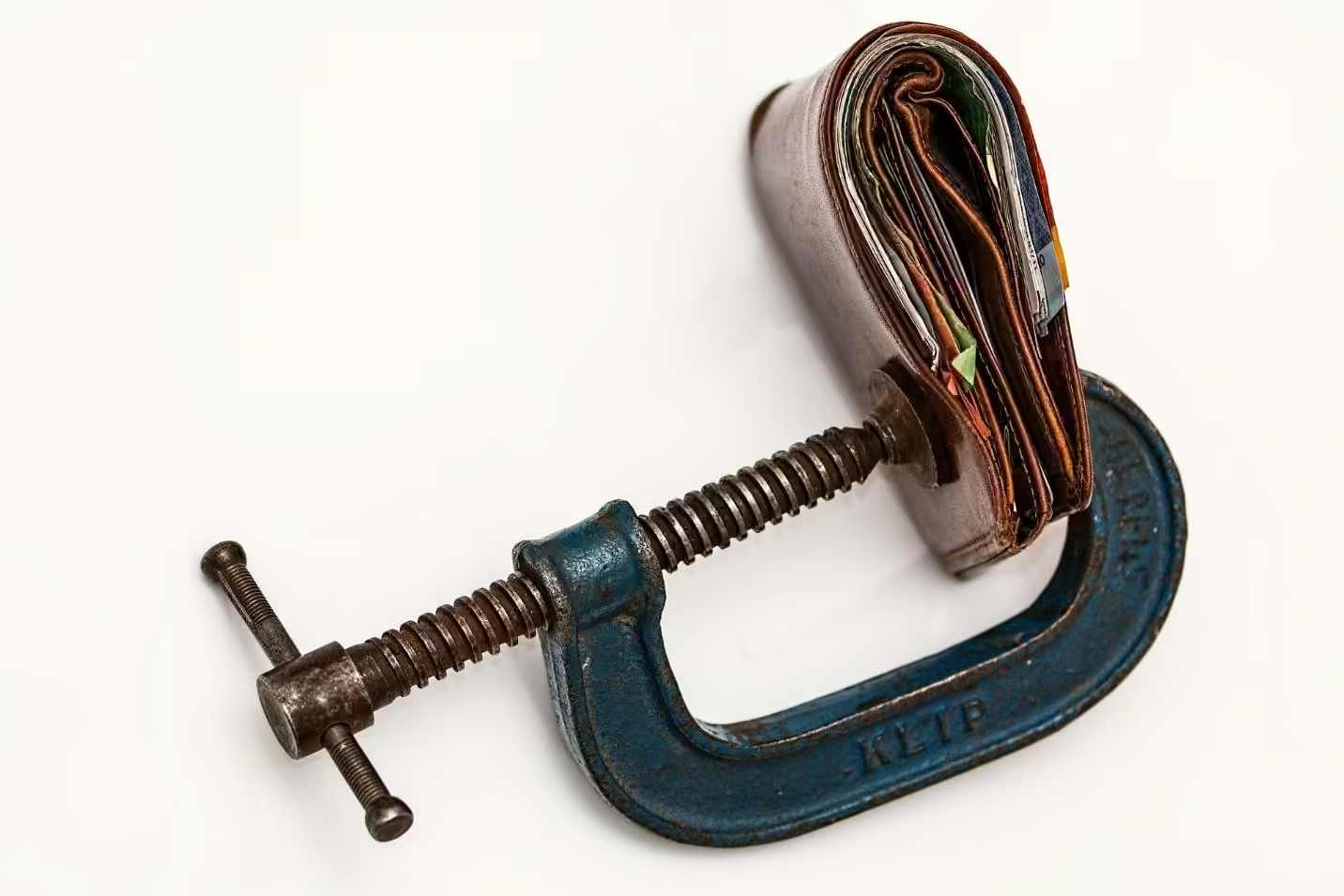

When money gets tight, every choice counts, especially the first 3 expenses to cut. Skipping payments, cutting random costs, or using debt to survive causes panic. But that only stretches the problem. The real solution is taking control quickly. And that starts with analyzing your expenses each month.

Think of your budget like a map. A clear personal budget example clears the path ahead, spots dead ends, and finds faster ways to reach your goal. Without this clarity, you’re driving blind. Tracking expenses gives you a clear picture of two things:

This article is a step-by-step guide to help you budget when money gets tight. You’ll discover the first 3 expenses to cut:

You’ll also learn how you can analyze your expenses and expense tracker apps and apply bonus tips to keep your budget lean.

The goal isn’t to make life miserable; it isn’t simply to save quickly while covering needs. Ready to control money decisions? Let’s build habits that protect you from future money crunches!

Blindly cutting costs can backfire. You need a smart strategy to review expense matters. And the smart strategy is to identify expenses you should review first. Even small items can drain your budget, so you have to be mindful.

Some are needs, others are wants, and some are simply unnecessary expenses. Here, understanding of types of expenses is crucial, like fixed, variable, discretionary, and occasional. They can help with deciding what to cut first.

Reviewing your expenses also prevents overcutting in areas where you need stability, like basic utilities or health care.

Think of this exercise as a financial health check. It shows leaks that need immediate attention so you can fix them fast, stops overspending, and creates space to save. Skipping this step often frustrates because you cut the wrong ends.

When reviewed regularly, this process builds awareness. You start spending with intention, not impulse. Over time, this habit helps you spend within your means, even on a low income.

When income drops, you need to save fast. A random approach can backfire. You might end up removing essentials while keeping unnecessary expenses.

The smart move is to focus on the biggest and easiest savings first. These three areas often help with quick wins without hurting your basic needs.

Reviewing housing and utilities is more about creating a sustainable budget than just about cutting costs. A clear personal budget shows how small and consistent adjustments free up cash for other priorities.

These simple birthday celebration ideas are affordable but packed with personality.

Subscriptions are easy to overlook, but they often drain your wallet quietly. Review streaming platforms, software, and memberships.

Start with recurring payments. Check for services you don’t use or rarely use. Cancelling or downgrading plans instantly saves some cash. Even minor subscription expenses matter over time.

A savings app or tracker can monitor recurring costs. It shows patterns and answers so you can analyze your expenses efficiently. You can quickly review your expenses and track what’s essential.

Keep subscriptions under control without sacrificing enjoyment. A practical budget shows how cutting just a few subscriptions can boost savings.

Food is essential, but it’s also an area where you can unknowingly overspend. You need to review your eating out, takeout, and impulse grocery buying patterns.

Track these expenses through an app or tracker. That’s how you can analyze where every dollar goes in this category. Identify unnecessary purchases. They look small but add up quickly.

Plan meals, buy in bulk, and cook at home. Review your grocery costs regularly. Review them and live frugally.

Just track expenses. Analyze them. Continue to make small, consistent changes here. Results will surprise you within a month.

Before you cut costs, you need to know where you spend money. Here’s a step-by-step guide to analyze your expenses so nothing slips through the cracks:

Collect Your Data: Collect data on where your money goes. Gather your last three months of bank statements, cash receipts, and credit card bills. This gives you a complete picture of your expenses, not just one month’s snapshot.

Sort by Category: Categorize your expenditures into housing, utilities, groceries, transportation, subscriptions, debt payments, and entertainment. This shows areas of your expenses.

Spot Trends: Look for patterns. Analyze trends in your utility bills. Are utility bills rising? How is the frequency of grocery trips? These insights spot where to look first.

Find Unnecessary Costs: Look into services you use, and find charges for services you don’t use. This can avoid impulse spending and fees.

Prioritize Cuts: Use your list to decide what you should cut first. Focus on big savings like housing, food, and subscriptions. Leave small luxuries for later.

Analyze your spending this way so you take control quickly. This analysis will open you to:

Big bills are easy to notice. It’s the small, daily purchases that quietly add up to big numbers and drain your wallet. Coffee runs, snacks, ride-sharing, or in-app purchases may look small but can equal a big bill by the end of the month.

The solution is to track every dollar you spend, no matter how small. Use a simple notebook. Try a spending tracker app to log each transaction. Doing this for just a few weeks will surprise you. You’ll see how often small leaks deprive you of money.

Once you know the total, you can start removing small habits to cut or replace them with more saving options. For example, brewing coffee at home or walking short distances saves more than you think, instead of paying for transport. Health benefits are even big.

Tracking builds awareness. It stops tiny expenses that sneak in. Over time, it becomes a habit, and you exercise more control over your expenses when money is tight.

A good expenses app makes tracking breezy. Here are a few excellent options you can start using right away:

Mint: It connects to your bank account. Tracks spending in real-time. Categorizes expenses for you.

YNAB (You Need A Budget): YNAB is a budget-every-dollar app. It assigns purpose to every dollar. With the best budgeting app, YNAB, you can plan ahead instead of just tracking past spending.

PocketGuard: This popular option shows how much money you have left after bills and savings. PocketGuard makes it simple to avoid overspending.

Goodbudget: Uses the digital envelope method. It’s perfect for people who want absolute control over each spending category.

Choose the one that suits your situation and money goals. The right tool makes it simple to stay consistent. It turns simple expense tracking into a lasting money habit.

Cutting costs works best when you do it regularly, not as a one-time event. Here are simple ways to turn these habits into a system and save more every month:

Schedule a Weekly Review: Give 10-15 minutes each week to check your spending and adjust where needed.

Use Cash for Discretionary Spending: It’s harder to overspend when money keeps leaving physically.

Automate Savings: Set a fixed amount for needs, wants, and savings right after payday. This move curbs the temptation to spend it.

Shop with a List: Whether groceries or essentials, make a shopping list to prevent impulse buying.

Cut One Extra Cost Each Month: Challenge yourself. Find and cut one more expense every month.

When you regularly evaluate your expenses and live frugally, you build money habits that last. Over time, you become more intentional about spending, avoid debt, and save more of what you earn.

Money stress feels heavy, but you can control it. The first step is awareness. Knowing where every penny goes gives you a major picture.

Now start with the 3 big areas: housing & utilities, subscriptions, and food. Cutting them a little can free up cash fast.

Keep reviewing your spending regularly. Use a spending tracker or app. That’ll help you stay accountable. Make small adjustments as needed. Over time, these money habits prevent you from future money crunches.

The goal is simple: spend wisely. Save regularly. Keep your essentials covered.

Small steps today will build a long-term future that’ll thank you for the steps taken today.

Make a budget for the lowest average income. It should tick all needs, wants, and savings boxes. When your income increases, increase the savings box accordingly. This extra income might pay off debt, boost savings, or be invested. Track it carefully. Make smart spending decisions.

A budget helps you track where your money goes. You can cut unnecessary expenses and allocate funds to priorities. A budget ensures you consistently save, meet needs, and stay on track toward your goals.

List your income. Create categories like needs, wants, and savings. Assign income straight to these categories on the payday. Adjust until your spending is lower, and save for any unexpected expenses.

Start simple. Track every expense for three months. Then group spending into categories. Set limits. Stick to them.

It means saving a set amount for yourself before spending on anything else. Pay yourself first. Treat it like a non-negotiable bill.

Focus on essentials like rent, food, and utilities first. Cut non-essentials. Find cheaper alternatives. It doesn’t go for an unhealthy approach. Automate even small savings.

Start with cancelling unnecessary subscriptions. Cook at home. If you have to go, limit it to weekends. Sell used items. Save any extra income.

4 types of expenses are:

Below are 10 expenses:

Start with collecting bills and bank statements. Categorize spending. Now track patterns. If you find any unnecessary costs, cut or reduce them.

Set a fixed percentage to save every month, and it should go straight every payday. Automate transfers so savings happen on autopilot.

Creating a budget develops discipline. Tracking income and expenses ensures. Your money works toward your financial goals instead of going to waste.