Powered by xeven pixels | Website design | seo

Share Article

Copy link

Copied to clipboard!

2 months ago

On irregular income, managing money is hard. This is exactly the case for freelancers. But it doesn’t mean you need complex accounting software. Simple and effective tools can track spending, set goals, and stay on top of bills.

In this blog, we’ll get into the details of the best budgeting apps in 2025. If you’re someone who juggles with flexible income and unpredictable expenses, stay with us.

A budgeting app simplifies categorizing and tracking your money. Users can usually set financial goals, categories transactions, and send notifications on spending. Many budgeting apps sync with your bank accounts that enables real-time snapshot of your finances.

As more people choose budgeting apps to manage their money, certain features are must-haves. Below are the attributes you should ensure in the budgeting app you choose.

A clean, intuitive interface is an essential feature in a budgeting app. Users want to log in and immediately check progress on their financial goals without guesswork, without steep learning curve. Whether it’s viewing account balances or adjusting budget categories, easy-to-use interface and easy navigation are key attributes. If the app feels complicated, it is more likely to be left quickly.

Many budgeters mainly use expense tracking, even outside of the apps. Therefore, it’s another must-have feature in the budgeting app.

Budgeting apps for freelancers should track expenses automatically, and categories them into groceries, bills, dining out, or gas, so users stay aware of where their money is going. They can easily spot on patterns, cut back where feel necessary, and stick with financial goals.

These tools help users determine and work on specific financial goals like an emergency fund or paying off debt. In special features, you may set savings targets and track progress as you go. Goal-setting keeps users motivated and focused on financial goals with a clear plan and visual checkpoints.

Sometimes budgeting apps offer solid financial insights. Tailored money saving tips or financial advice to save are also offers but not often essential. Many users consider financial advice nice. This serves both who prefer to make budgeting decisions on their own or seek guidance elsewhere.

This feature sends automatic reminders to users about upcoming bills and payment due dates. This simply prevents missing payments, avoids late fees, and keeps a positive credit profile. These automatic notifications keep you organized and make sure your bills are paid on time.

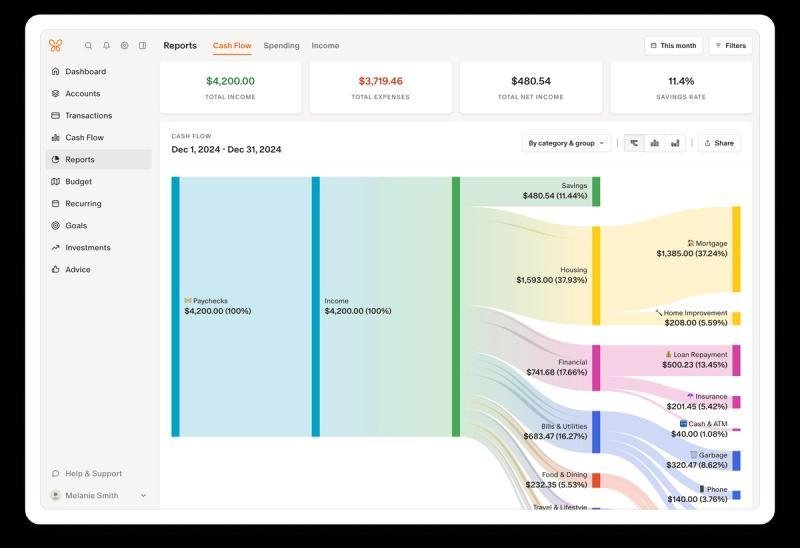

The Monarch budgeting app is an excellent app for overall budgeting. Its user-friendly interface is so beautiful and informative. The dashboard is friendly and gives you quick access to your most important budget details. These details could be recent transactions, your income comparison, running month’s expenses, and your net worth. For instance you’re saving for emergency funds, the dashboard will show progress.

Linking bank accounts and credit cards takes not long and is quite easy. Monarch collects your transaction and balance data into the app. Here you can easily create budgets and goals. You can also track your recurring expenses to keep eye on subscriptions and to avoid any surprises. Monarch is compatible with both tablet and smartphone app. If you’re looking for best budgeting apps for freelancers iOS, Monarch Money is an excellent pick.

With Monarch, you can connect all your accounts, and track spending by each category or account. Track your expenditures based on fixed and flexible spending. You can track the performance and allocation of your investments. Join Monarch to set financial goals, set for emergencies, plan for the whole year, and sync with Coinbase, Zillow, Apple Card and vehicle values.

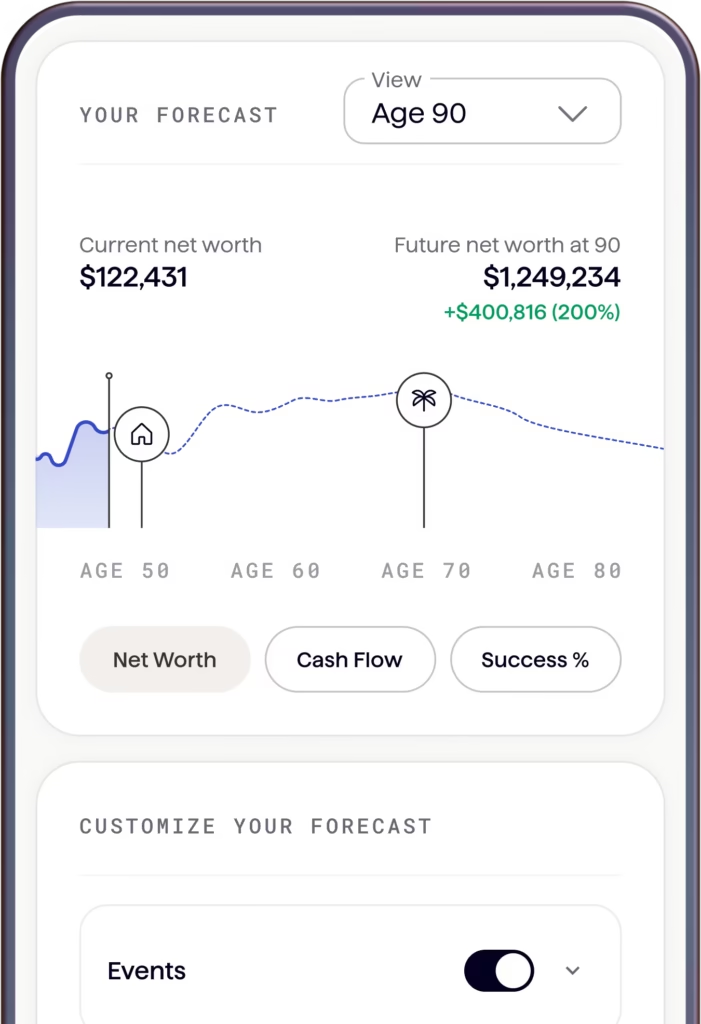

The Origin app is a unique budgeting app. For starters, it’s something more than just budgeting. For instance, Origin app lets you track your investments, save cash with a competitive APY, invest with index funds, create a trust, create your will, etc.

Most of these features are included in the monthly or yearly subscription fee. Those features that require additional fees like creating a trust or talking with a CFP, are priced reasonably.

AI has also integrated in the Origin app. You can get help from AI on budget, such as help with creating an emergency fund.

If someone asks me, is there a good budgeting app? I suggest Origin because it’s one of the most advanced and feature-rich money apps I’ve ever seen. Origin has a 7-day free trial. After that it costs $12.99 a month or $99 a year.

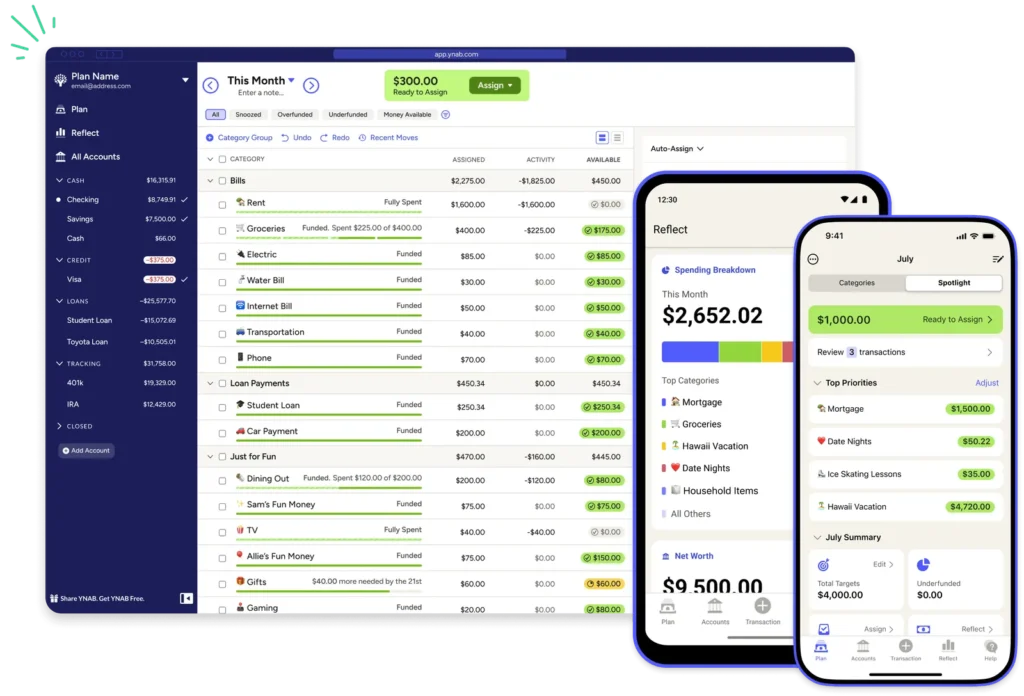

YNAB (You Need A Budget) works by assigning a purpose to every dollar, so you left nothing to spend aimlessly. You can get automatic updates by connecting your bank accounts or add transactions yourself if you prefer. App allows you to set up budget categories, so you plan what matters the most to you.

YNAB is the best every dollar budgeting app for detailed, hands-on budgeting and long-term financial planning. YNAB has a free 30-day trial, and $14.99 per month or $99 per year.

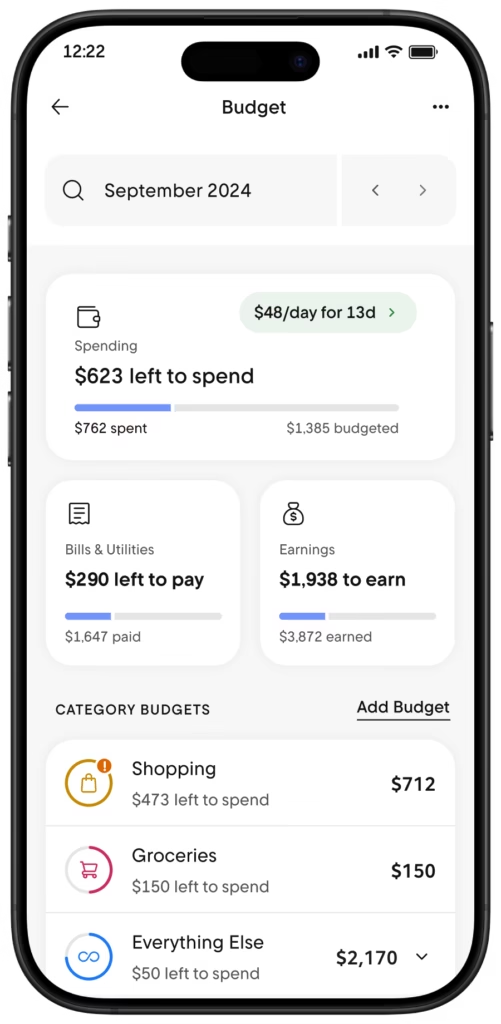

For both web and smartphone apps, Rocket Money is one of the top rated free budgeting apps with a solid premium version. It’s best looking and easy-to-use budgeting tool. On top of that, its premium version just costs as little as $6 a month, paid annually.

Rocket Money has strong basics. Users can easily track their spending and set up budgets. You can breezily create rules for automatically categorizing transactions, and connect your investment accounts if you want to.

Rocket Money manages your subscriptions, calendar budget, bill negotiations, track your net worth, and much more. It’s easy to get snapshot of your money management. App has both free and premium versions. The paid version costs $6 to $12/mo based on whatever you want to pay.

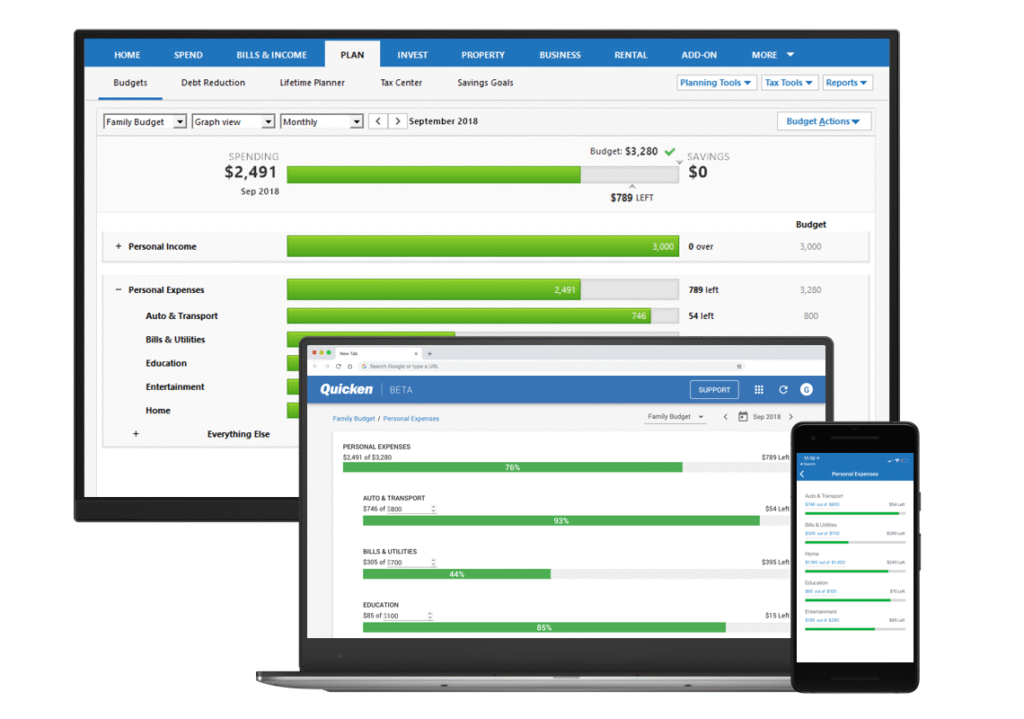

Quicken is a subscription-based financial planning software. It’s compatible with both PCs and Macs with some differences between the two versions. Quicken Online is not available anymore. Still, it’s one of the best budgeting apps of 2025.

Quicken is popular as a comprehensive budgeting app. It includes almost every budgeting feature, such as categorizing expenses, setting goals, paying bills, and running reports.

Users can create saving goals, manage and reduce debts, create and track budget, and more. You can link all your banking and investment accounts. Users also get some insights into investments, including asset allocation. Quicken offers two plans, Quicken Deluxe and Premium, cost $5.99/month and $7.99/month, and billed annually.

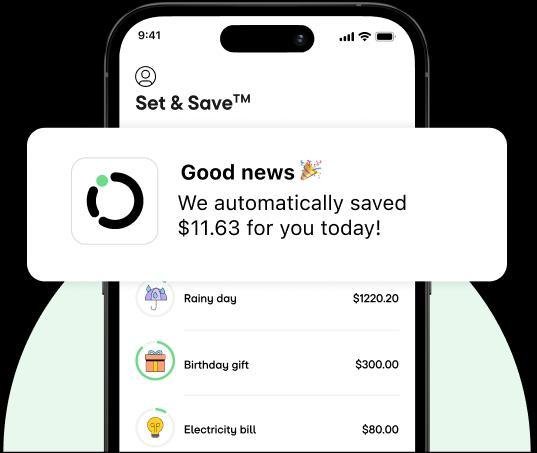

Oportun’s saving tools make saving hassle free. You can quietly move money from your account according to your income, bills, and spending habit. User won’t have to constantly think about it or make manual transfers. Everything happens automatically. In other words, your savings keep building without even noticing. App makes hitting your goals less overwhelming.

Oportun is an effortless, AI-powered saving model without manual input. It has a free trial and then costs $5 per month. Oportun is your intuit budgeting app.

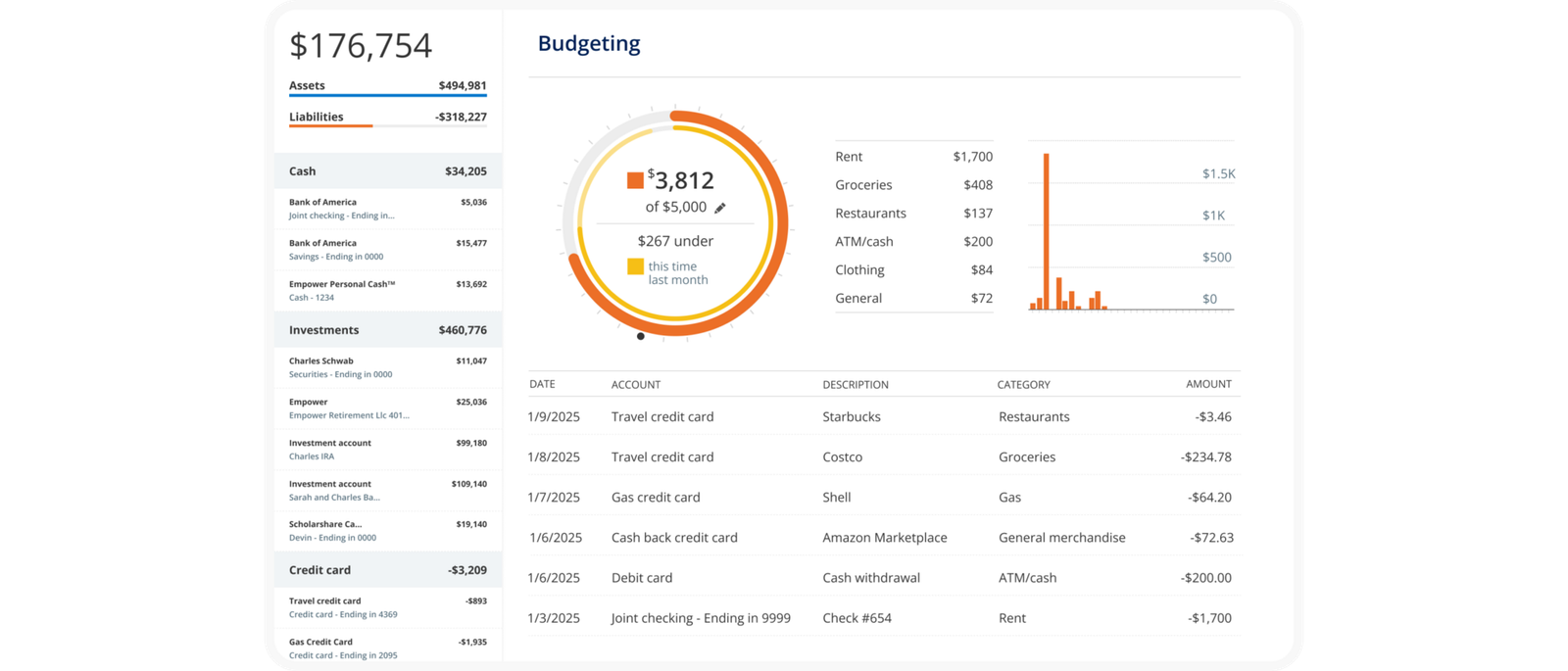

Empower is the best app for tracking investments. It features several tools to track your finances and analyze your investments. You can almost link any financial account to Empower’s app. As you link, the dashboard gives complete financial snapshot.

Budgeting as a freelancer is quite easy with Empower, especially from investment perspective. It tracks spending by category or account. It features retirement plan with monte carlo analysis. Users can understand how investment fees erode your wealth, and monitor portfolio’s asset allocation. You can track your net worth, get alerts on bill due date, and save for emergencies. Newly added feature allows you to track Bitcoin, Ethereum, Litecoin, and thousands of other tokens, right from the app.

Empower app is also available for both tablets and smartphones. The app is user-friendly and interface is exceptional.

Online banking and money management tools are pretty clear here to stay. That’s a good thing for who has to go through paper paychecks and to the bank to deposit checks. Your mobile financial snapshot is magical.

But the question is, are budgeting apps really worth it?

It depends. Your preferences and what works for you decide whether or not a budgeting app is worth it. Every system is good that works for you. You don’t necessarily need to signup to a budgeting app just because that’s the latest trend

Managing money on freelancing shouldn’t be stressful. The best budgeting apps for freelancers in 2025, such as Monarch Money, Origin, YNAB, Rocket Money, or Quicken offer exciting features that make tracking expenses, setting goals, and growing savings quite easy.

From a simple app for expense tracking to an advanced tool for investment insights, options exist that fit your needs. Ultimately, the right budgeting app keeps you on top of bills, build financial discipline, and reach your money goals, without using any complex accounting software.

Yes, Rocket Money is a solid budgeting app if you’re looking for a full-service app. It’s not free but can actively save you money. Rocket Money gives complete freedom to build a budget, monitor your credit score, track your net worth, negotiate your bills, and cancel subscriptions that you no longer need. Plus, users also get customized financial insights. Rocket Money is arguably one of the best budgeting apps for self-employed.

enerally, it’s a yes! Budget apps are often safe, but we suggest you do due diligence before joining. When we review and recommend an app, we go into details of app’s security features. We suggest you the same. If the app doesn’t explain how to keep your data safe, look elsewhere. Most apps employ bank grade encryption or better to secure your data. In addition, many apps ask for two-factor authorization. Take advantage of those security updates.

If you don’t want to link your bank account, you still have plenty of options. YNAB is a solid example that requires linking to your accounts, but you don’t necessarily have to.

Many budgeting apps have a feature called “envelope budgeting,” which is basically a budget strategy. User can allocate a certain amount of money for different purposes or categories monthly in advance. This feature ensures money goes where it is intended. User sticks with it and avoids overspending.